February 3, 2022, by Tamarine Cornelius

A group of conservative business lobbyists have proposed a radical change that would raise taxes on people with the lowest incomes to cover part of the cost of giving huge tax cuts to the wealthy and powerful. The plan would result in the largest tax cuts going to white households, with households of color receiving smaller tax cuts or having to pay more in taxes. The enormous cost of the proposal would make it difficult for the state to provide even basic public services that schools, businesses, and families need to thrive.

Last month, an influential group of lobbyists released a proposal to raise Wisconsin’s sales tax to eight percent, making it the highest state sales tax in the country, and eliminate the state individual income tax, Wisconsin’s biggest source of revenue.

An extremely large tax cut for the wealthy and powerful

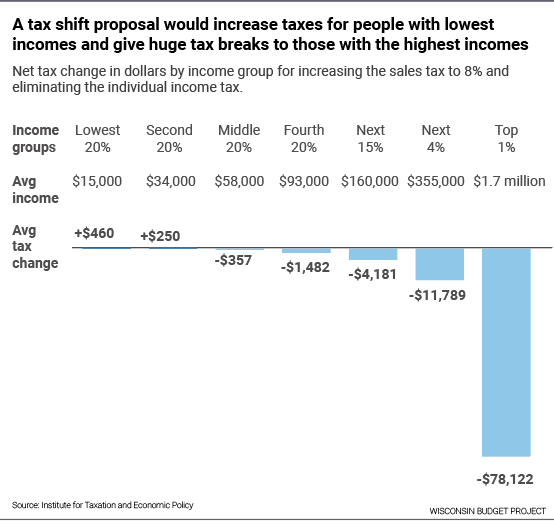

This change would give enormous tax cuts to the top 1% by income. Tax filers in the top 1% – a group with an average income of $1.7 million – would get a tax cut of $78,000 on average. That is more than a typical Wisconsin earns over the course of a year. In contrast, a tax filer in the middle 20% by income would get an average tax cut of just $357, or less than a dollar a day. Put another way, a filer in the top 1% would get a tax cut that is 219 times as large in dollar amounts as a tax filer in the middle group, on average.

Filers with low incomes would actually pay more in taxes under this plan than before the change. A filer in the bottom 20% by income, a group with an average income of $15,000, would expect to pay $460 more a year in taxes on average. Filers in the second 20% by income would also have their taxes hiked, paying $250 more on average. Taxes could also increase for middle-income Wisconsinites if the large reduction in total tax revenue results in cuts to state property tax relief or keeps that relief from growing in proportion to property taxes.

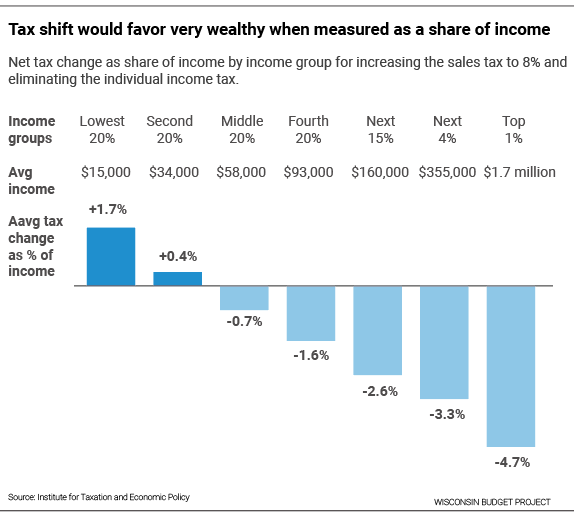

This pattern of big tax cuts for people with the highest incomes, and tax increases or much smaller tax cuts for people with lower incomes also holds true if the tax change is measured as a share of income, instead of in dollar amounts. The lowest-income households would pay an additional 3.0% of their income in taxes from this change, on average. In contrast, the top 1% would receive the biggest tax cut measured as a share of income, at -4.7%.

This distribution change is because the sales tax is regressive, meaning that people with lower incomes pay a higher share of their income in that tax, while Wisconsin’s income tax is somewhat progressive, meaning that people with higher incomes pay a higher share of their income in that tax. Because of these tax characteristics, increasing the sales tax while cutting the income tax, as this plan does, usually results in a tax shift to people with lower incomes.

Even without the regressive change that has been proposed, Wisconsin’s tax system already requires people with low incomes to pay a higher share of their incomes in state and local taxes than people with much higher earnings. The lowest 20% of Wisconsin households by income currently pay 10.1% of their income in state and local taxes. In contrast, the top 1% of households by income pay only 7.7% of their income in state and local taxes. Passing this plan would further skew Wisconsin’s tax system in favor of the very wealthy, and widen the economic divide between the top 1% and everyone else.

White filers would get bigger tax cuts than filers of other races

Wisconsin’s tax code is a major driver of economic and racial inequality, and contributes to the increasing concentration of income and wealth in a few hands—hands that are most likely to be White, due to a long history of racial discrimination. By targeting the bulk of a mammoth tax cut to white households, this proposal would make it harder for families of color to thrive.

The tax change would favor White filers over people of other races and ethnicities. White filers would get a tax cut ($2,394) more than three times as large in dollar amounts as Black filers ($741), on average. Latinx filers would have a tax increase of $282 on average.

Measured as a share of income, the largest tax cuts again go to White filers, who would get a tax cut of 2.3% of their income, on average. Black filers would get a tax cut equivalent to only 1.0% of their income. Latinx filers would have a tax increase of 0.5% of their income on average.

Likely outcome: Loss of critical services

This change would result in a massive revenue loss that would make it much more difficult for Wisconsin to make investments in families, schools, communities, and public infrastructure. The state would lose an estimated $5.3 billion in tax revenue a year, forcing the harmful elimination of entire categories of services that make Wisconsin an attractive place to live, work, and do business. To put the tax cut in perspective, it would require budget cuts equivalent to ending the state support for BadgerCare, the program that provides health care for people with low incomes; closing every prison in the state; and ending state support for Wisconsin’s technical college system, all combined.

Increasing the sales tax to make up for a cut in income taxes moves the responsibility for paying taxes away from the rich and powerful, and onto the backs of people with low and moderate incomes. It would funnel larger tax cuts into the pockets of white filers while shorting households of color or even requiring them to pay more. This tax shift is paired with an enormous tax cut, one that would strip billions from kids’ classrooms, our health care system and public infrastructure — the very things that Wisconsin businesses and families need to succeed. We can’t create broad-based prosperity for Wisconsin by raising taxes on the families who can least afford it, just to pay for tax cuts for the rich, while making it impossible for Wisconsin to afford to support its families and communities.

Methodology

The Institute for Taxation and Economic Policy provided the analysis of distribution changes. This analysis assumes Wisconsin’s Earned Income Tax Credit and the Homestead Credit, two refundable income tax credits, would be eliminated along with the state’s individual income tax. Of the nine states that lack an income tax, none currently have an Earned Income Tax Credit, although one state has an EITC planned for the future. Only one state of the nine has a property tax circuit breaker credit similar to Wisconsin’s Homestead Credit, albeit with much more limited eligibility. If the refundable credits were included in the analysis, the amounts of the tax changes for low and moderate income groups would change slightly but the results would still be strongly skewed towards filers in the top 1%.