October 6, 2020, by Tamarine Cornelius

The disclosure that President Trump pays next to nothing in income taxes has highlighted the fact that the federal tax system is stuffed full of loopholes that are only available to the ultra-wealthy. But you don’t have to look to the federal system to find a tax code tilted in favor of the rich and powerful. Wisconsin’s own state and local tax system is also loaded up with a collection of special-interest tax breaks that siphons revenue away from where it is needed most, and instead directs it towards a small number of wealthy, well-connected individuals and big corporations who have rigged the system for their own benefit.

Wisconsin’s tax code is a major driver of economic inequality, and contributes to the increasing concentration of income and wealth in a few hands — hands that are most likely to be white, due to a long history of racial discrimination. Our slanted tax system isn’t the only reason for Wisconsin’s enormous racial disparities, but it contributes by saddling residents of color with an unfair economic burden that makes it harder for them to succeed financially. Generations of racial discrimination have made it more difficult for people of color to build wealth, and as a result, tax breaks for income generated by wealth disproportionately benefit White residents over Black, Latinx, and Native American residents.

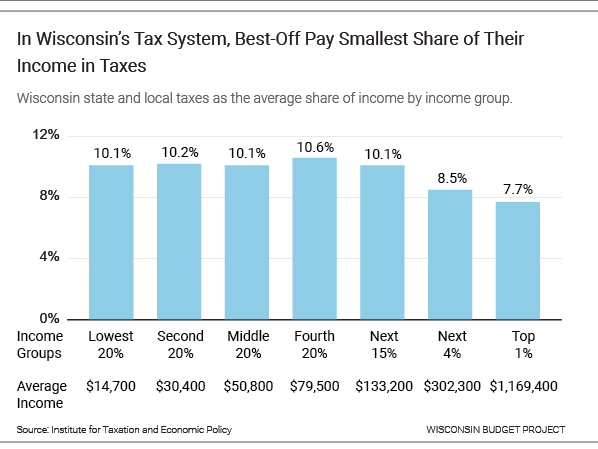

Wisconsin’s tax system provides a significant advantage to wealthy taxpayers over everyone else. The richest residents of Wisconsin pay the smallest share of their income in taxes of any income group, leaving Wisconsin residents with low and moderate incomes to make up the difference. Taxpayers in the top 1% pay just 7.7% of their income in state and local income taxes, compared to 10.1% paid by taxpayers in the bottom 20%.

Wisconsin tax breaks that allow some wealthy and powerful people to pay less than their fair share of taxes include:

- A tax credit for manufacturers that allows businesses or business owners to pay next to nothing in state income taxes. This credit is so slanted that most of the tax break that is claimed through the individual income tax goes to multi-millionaires. (Not just millionaires, but multi-millionaires.) For people who claimed the credit and had incomes of more than $30 million, this credit provided an average tax break of $1.8 million each. Owners and businesses do not need to create new jobs to be eligible to claim the credit. Even businesses that lay off workers, send jobs overseas, and close factories may receive this tax break.

- A provision that favors income earned from wealth over income earned from work. Wisconsin is one of only a few states that gives preferential tax treatment to income earned from investments, taxing that income at a lower rate than income that comes from earning a paycheck at a job. This practice means that people who already have a lot of money and live off their investments can pay a lower income tax rate than people who work for a living.

- A new tax break for people who roll their profits from investments into funds that invest in certain designated neighborhoods or “Opportunity Zones.” These funds generally have a minimum income requirement of at least $200,000 for individuals and $300,000 for couples. The top 1% of people by income will reap an estimated three-quarters of the Opportunity Zone tax breaks in Wisconsin.

In Wisconsin, as at the federal level, lawmakers have written the tax code so as to allow the wealthy and powerful to sidestep paying the taxes that are necessary to fund thriving communities, excellent schools, and modern transportation networks. These loopholes drive up taxes for people who live paycheck to paycheck, and also starve communities of the revenue they need to provide critical public services.