January 27, 2020

Despite recent increases, Wisconsin’s public K-12 school districts still receive less in state aid than they did a decade ago, prior to historic cuts to education. During that timeframe, state lawmakers chose to pass large tax cuts instead of investing the money in local schools. Lawmakers are also increasingly diverting resources allocated for education to private schools and independent charter schools, reducing the resources available for public school districts, which educate the vast majority of Wisconsin students.

Deep funding cuts threaten Wisconsin’s tradition of high-quality public schools, which have long been an engine of Wisconsin’s economic growth. Wisconsin depends on a well-educated workforce, shaped by outstanding public schools, to lay the foundation for a shared prosperity. To ensure that Wisconsin is competitive in the future, Wisconsin schools must have the resources to offer students a first-rate education.

Legislators can boost resources for public education by scaling back the growth of tax cuts, particularly the ones that give outsized benefit to the highest earners, and redirecting the money to public schools. Doing so would shift money away from tax cuts for the wealthy and well-connected, and instead put it to use educating the next generation of Wisconsin workers. Lawmakers can also slow the growth of separate school systems that are funded in part by reducing resources for public school districts.

Wisconsin school districts are funded mostly through a combination of state aid and local property tax revenues. As the state has reduced its commitment to public school funding, local property taxpayers have increasingly been forced to pick up the slack, with record number of referendums passing since the enactment of the historic cuts. This analysis focuses solely on changes in state aid to public school districts, and excludes local property tax revenue as well as state aid that is withheld or deducted from school districts.

Severe Cuts to School Districts Have Not Been Fully Restored

Wisconsin residents understand the value that excellent public schools bring to students, families, and communities, and have a long history of supporting significant investments of public resources for schools. Fifty-five percent of Wisconsin residents would rather increase spending on public schools than reduce property taxes, according to a January 2019 poll from Marquette University. Only 39% favor reducing property taxes.

Students across Wisconsin pay the price when state lawmakers cut support for public schools. Fewer resources for schools means that students have to scrape by with outdated technology, attend classes taught by educators who are teaching outside their areas of expertise, or learn in dilapidated physical environments. In severe cases, the loss of state aid may force the closure of an entire district, forcing students to travel long distances and potentially dealing a severe blow to communities struggling to stay economically vibrant.

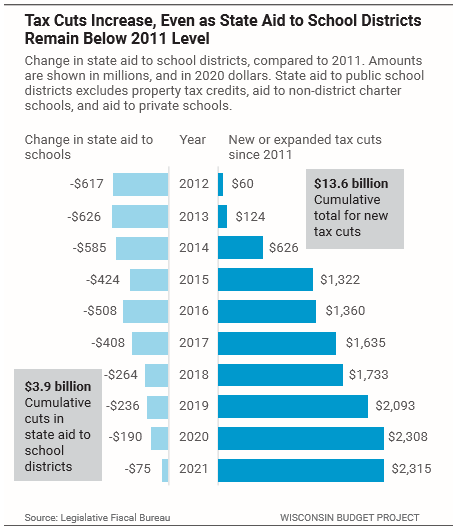

In 2021, the state will invest less in public school districts than it did in 2011, something that has been true of every year in between as well. In 2021, Wisconsin school districts will receive $75 million less in state aid than in 2011 in inflation-adjusted dollars, or 1.2% less than in 2011.

Over time, the budget cuts to public school districts have accumulated. Between 2012 and 2021, the state provided $3.9 billion less in state aid to school districts than it would have if state aid had been kept at 2011 levels.

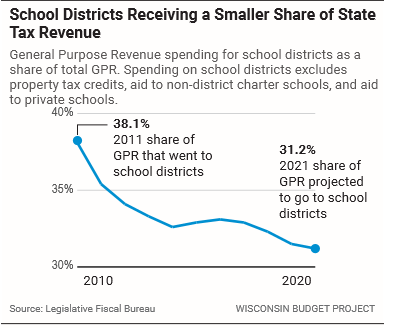

In another measure of how lawmakers have shifted state aid away from school districts, the share of state tax revenue dedicated to districts has declined since 2011. That year, the state devoted $3.81 out of every $10 in tax revenue to school districts. In contrast, the state is projected to spend just $3.12 out of every $10 in tax revenue on school districts in 2021, a decline of 15% since 2011.

Costs of Tax Cuts Climbs, Draining Resources for Public Schools

One reason state aid for school districts has declined is that lawmakers have allocated an increasing amount of resources to tax cuts, many of which disproportionately benefit the wealthy and well-connected. The severe cuts to education were made in 2011, in the aftermath of the Great Recession and during a time of decreased tax revenue. But as the economy improved, state lawmakers focused on continuing to cut taxes rather than restoring state support to educate students in Wisconsin’s school districts.

State lawmakers have enacted more than 100 tax cuts since January 2011, some of which are extremely slanted in favor of the rich and powerful. One example is the Manufacturing Credit, which in 2019 gave 21 tax filers—each of whom earned over $30 million—an average estimated tax cut of $1.9 million each, according to figures from the Legislative Fiscal Bureau. The Manufacturing Credit, which results in manufacturers paying virtually no state income tax, reduced state revenue by $283 million in 2019. To put that amount in context, it is more state money than the school districts of Waukesha, Appleton, and Madison got that year, put together.

The combined cost of the new tax cuts has climbed each year, starting from a low of $60 million in 2012, and reaching $2.4 billion in 2021 in inflation-adjusted dollars. The combined total cost of the tax cuts adds up to $13.6 billion over ten years.

The tax cuts have drained money from public schools. If lawmakers had declined to pass new tax cuts and instead appropriated that money in the same proportion as other state tax money is spent, the result would have been an additional $727 million available for public school districts this year. Even just eliminating a single tax cut—the Manufacturing Credit—and dedicating the revenue to public schools would increase state support well past 2011 levels.

Increasing Amount of State Resources for Education Diverted from School Districts

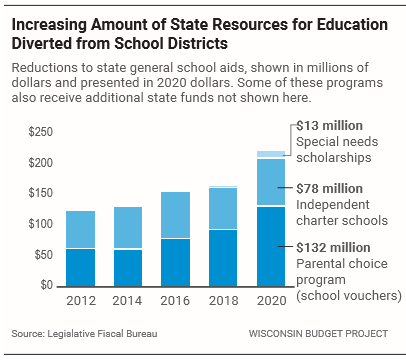

Over the past decade, the state increased the amount of public money going to private schools and charter schools that operate independently from school districts. To offset the cost of funding these separate school systems, state lawmakers redirected state aid that would otherwise go to public school districts. The total cost of that redirected state aid has risen sharply, increasing from $133 million in 2012 to $223 million in 2020, an increase of 68%. These separate school systems also receive additional state funding that does not represent a direct loss of funding for school districts.

The transfer of state aid from school districts to private and charter schools represents a relatively small share of overall state aid for public schools. However, that share has grown rapidly and may continue to swell in the future.

Challenges Facing Wisconsin’s Schools

Wisconsin’s goal for funding public school districts should be to insure that all students have access to an excellent public education. To achieve that goal, it is not enough for state funding to simply keep up with inflation—though the state is falling short of even this low bar. Instead, the state needs to provide additional resources in areas in which costs continue to rise, particularly in special education services and services to students who are learning English.

To make sure that the doors of opportunity are open to everyone, Wisconsin needs to make sure that students from across the state, and particularly those in communities furthest from opportunity, have equitable access to academic and educational resources. In particular, this means that Wisconsin needs to support rural school districts, especially those struggling with the effects of declining student population, and schools in which a large number of students come from families with low incomes. With state aid for public school districts still below the levels of a decade ago, Wisconsin will struggle to provide students with an exceptional public school education that they can use as a foundation for success later in life.