May 3, 2022, by Tamarine Cornelius

Eliminating Wisconsin’s income tax would funnel enormous tax cuts into the pockets of the wealthy and powerful, potentially raise taxes on people with the lowest incomes, and make it nearly impossible for Wisconsin to make the kind of investments that make the state a good place to live, do business, and raise a family. It would also widen the already-large gaps in well-being among people of different races, a gap that continues to hamstring Wisconsin’s economy.

All that hasn’t stopped an influential cabal of lobbyists and lawmakers from trying to do away with Wisconsin’s income tax and with it, the revenue that supports critical public services like education and health care.

There have been several proposals this year targeting the individual income tax, and while they differ in some respects, they share the common goals of restructuring our state and local tax system to favor the rich even more than it already does, and to severely undercut services that Wisconsin families need to thrive.

Eliminating Wisconsin’s income tax would give an enormous tax break to tax filers in the top 1% – a group with an average income of $1.7 million. The top 1% of households would get an average tax break of $85,500 if the income tax were eliminated, which is more than a typical Wisconsin family earns in an entire year. That’s also more than 60 times the size of the average tax cut that a middle-income taxpayer would get. (These figures and the other numbers in this analysis are from the Institute on Taxation and Economic Policy.)

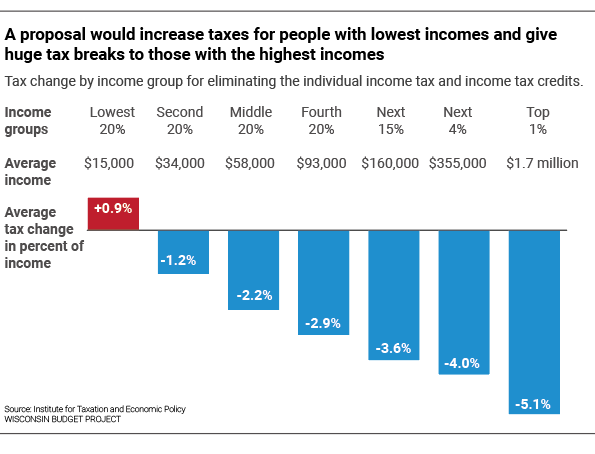

While the wealthy and powerful reap big rewards from ending the income tax, taxes for working people with low incomes could actually increase if the income tax were eliminated. A household in the lowest 20% by income – a group with an average income of $15,000 – would pay $139 more on average if the income tax was ended. That’s because states that do not have an income tax typically do not have income tax credits, some of which can exceed the amount of a person’s income tax liability and help make the state’s tax system more equitable.

Even when taking relative income size into account, the wealthiest would get by far the largest tax cut of any income group. The top 1% would get a tax cut equivalent to 5.1% of their income on average, which is more than twice as large as middle-income tax filers would get. Households in the lowest income category would pay 0.9% more of their income in taxes if the income tax and credits were eliminated.

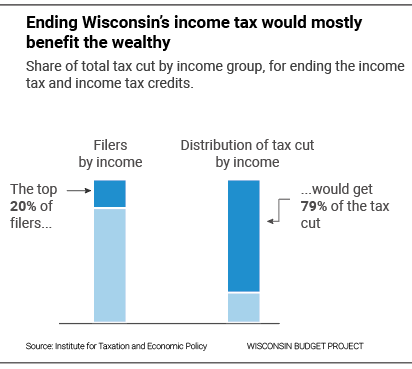

Analyzing the distribution of the total tax cut by income group is another way of demonstrating how ending the income tax would mostly benefit people with the highest incomes. The top 20% of tax filers by income would get 79% of the value of the total tax cut, leaving just 21% of the total tax cut for the remaining 80% of filers.

Wisconsin’s tax code is already a major driver of economic and racial inequality, and contributes to the increasing concentration of income and wealth in a few hands—hands that are most likely to be White, due to a long history of racial discrimination. Getting rid of the income tax would target the bulk of a mammoth tax cut to White households and make it harder for families of color to thrive. White households would see their share of income paid in taxes go down by 47%, compared to just 29% for Black households, 32% for Hispanic households, 36% for American Indian households, and 37% for Asian households.

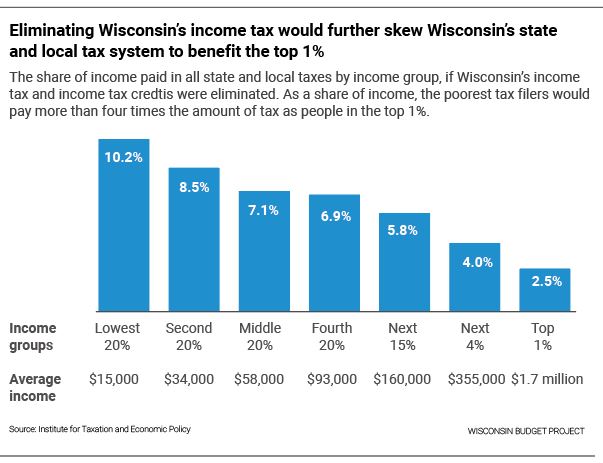

Ending Wisconsin’s income tax would radically skew Wisconsin’s state and local tax system to benefit the wealthy more than it already does, making it one of the most regressive tax systems in the country. That’s because the income tax is the only part of Wisconsin’s state and local tax system that is progressive, meaning that people with higher incomes pay a larger share of their income in tax than people with lower incomes. Eliminating the income tax would leave only the property tax and the sales tax, both of which are regressive in that they fall the heaviest on people with low incomes.

In addition to favoring the wealthy and powerful, eliminating the income tax would strip billions of dollars from critical public infrastructure and services that Wisconsin businesses, families and communities need to succeed. Axing the income tax would reduce public revenue by about $9 billion a year. To put that in perspective, reducing revenue by that amount would require budget cuts equivalent to ending state support for K-12 education, closing every prison in the state, and doubling University of Wisconsin tuition costs – combined.

One of the largest areas of state spending is property tax relief. The huge loss of revenue from ending or phasing out the income tax would probably force state policymakers to reduce spending for property tax relief, or at least freeze it. That would result in an even larger share of income being paid for taxes by low- and middle-income Wisconsinites than the previous graph indicates.

For Wisconsin’s economy to work for everyone, we need a tax system that provides enough resources to fund investments in healthy communities and public infrastructure, while providing a level playing field for Wisconsin families and businesses. Our tax system should take an active role in expanding opportunity and undoing the legacy of racial discrimination that makes it difficult for many families of color to thrive. Eliminating the income tax would move us in the opposite direction, by doubling down on tax changes that have directed a disproportionate share of resources to White households, and by widening the economic divide between the top 1% and everyone else.