April 5, 2021, by Tamarine Cornelius

Governor Evers’ proposed budget includes changes that would reshape Wisconsin’s tax code to give less of an advantage to wealthy and powerful interests, by reining in wasteful tax breaks for the rich and redirecting some of the benefits to the middle class and people with low incomes.

State tax policies can be a powerful tool for expanding opportunity and enhancing racial equity. But Wisconsin’s tax system is a major driver of economic inequality and contributes to the increasing concentration of income and wealth in a few hands —hands that are most likely to be white, due to a long history of racial discrimination.

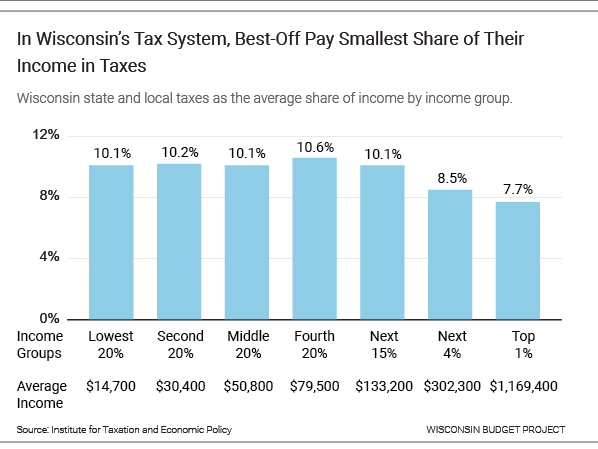

Wisconsin’s tax system gives an advantage to very rich taxpayers by requiring them to pay a smaller share of their income in taxes, while requiring taxpayers with lower incomes to pay correspondingly more of their income in taxes. Due to powerful interests that have been able to rig the rules to their own benefit, Wisconsin taxpayers in the top 1% by income – a group with an average income of $1.2 million – pay just 7.7% of their income in state and local income taxes. In contrast, taxpayers in the bottom income group, who have an average income of $14,700, pay 10.1% of their income in taxes on average.

Governor Evers’ budget takes two approaches to reducing the preference that our tax system gives to the very wealthy. The first is expanding tax cuts aimed at people with low and middle incomes, so that people with lower incomes pay a reduced amount of tax. To that end, his budget includes changes that would:

- Lower taxes for working parents, by increasing the Earned Income Tax Credit by $79 million this year.

- Help people with low incomes afford to stay in their homes, by improving the Homestead Credit in a way that delivers an additional $35 million in property tax credits this year to low-income households, including seniors and renters.

- Make child care more affordable, by establishing a tax credit for child care expenses, which would lower parents’ taxes by $10 million this year.

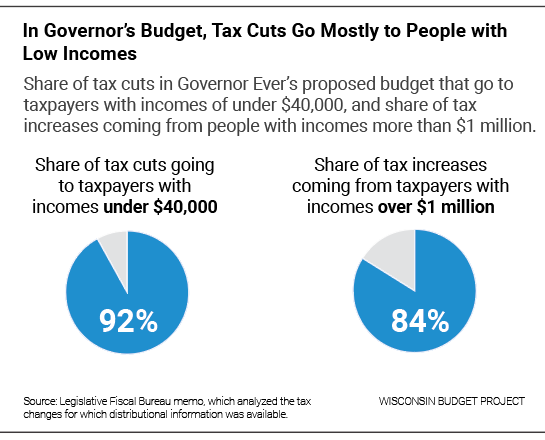

The tax cuts mostly go to taxpayers with low incomes, with nearly all — 92% — going to people with incomes of $40,000 or less, according to a Legislative Fiscal Bureau memo that analyzed the tax changes for which distributional information was available.

The other way Governor Evers is making the tax system less unfair is to close tax loopholes that give an advantage to the wealthy and powerful. Closing those loopholes would increase the amount of tax paid by the wealthy. The Evers budget would:

- Require big manufacturers to pay their fair share of taxes that fund excellent schools, a healthy workforce, and thriving communities. Governor Evers has proposed changes to a tax credit that lets manufacturers get away with paying next to nothing in income taxes. These changes would reduce the cost of the credit by $183 million this year.

- Tax income from wealth at the same rate as income from work. The Governor wants to significantly reduce the preferential tax treatment that the state gives for income earned from investments, as compared to income earned from a paycheck. Narrowing eligibility for this loophole would increase revenue by $153 million this year.

- Establish an income limit for a tax break for sending children to private schools, which mostly goes to people with high incomes, and which would bring in an additional $6 million this year.

Most of the additional revenue brought in by tax increases would come from millionaires, with 84% coming from taxpayers with incomes of $1 million or more.

In Wisconsin and elsewhere, the wealthiest have seen their incomes skyrocket in recent decades, while incomes have stagnated for the middle class and those who struggle to make ends meet. Wisconsin’s state and local tax system contributes to the growing chasm between the very rich and everyone else. The tax changes proposed by Governor Evers would be an important first step in moving our tax system closer to being a level playing field for Wisconsin families and businesses.