August 9, 2021, by Tamarine Cornelius

The huge tax cut that Wisconsin lawmakers passed in the state budget far outstrips the minimal investments they made in critical priorities like education, health, and workforce development. The size of the tax cut will make it harder for schools, communities, and families with low incomes to get the resources they need to thrive. Diverting billions of dollars to a tax cut that leaves out people with low incomes will also make it more difficult for the state to address the racial disparities that hold back Wisconsin.

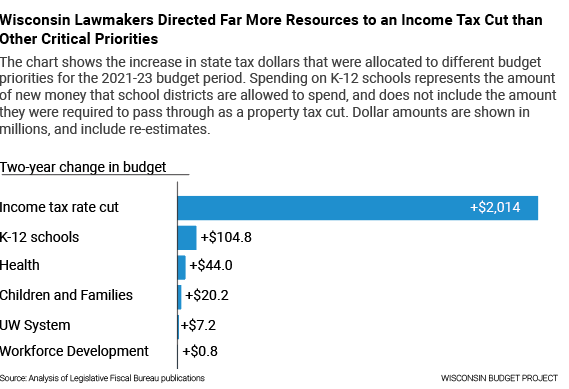

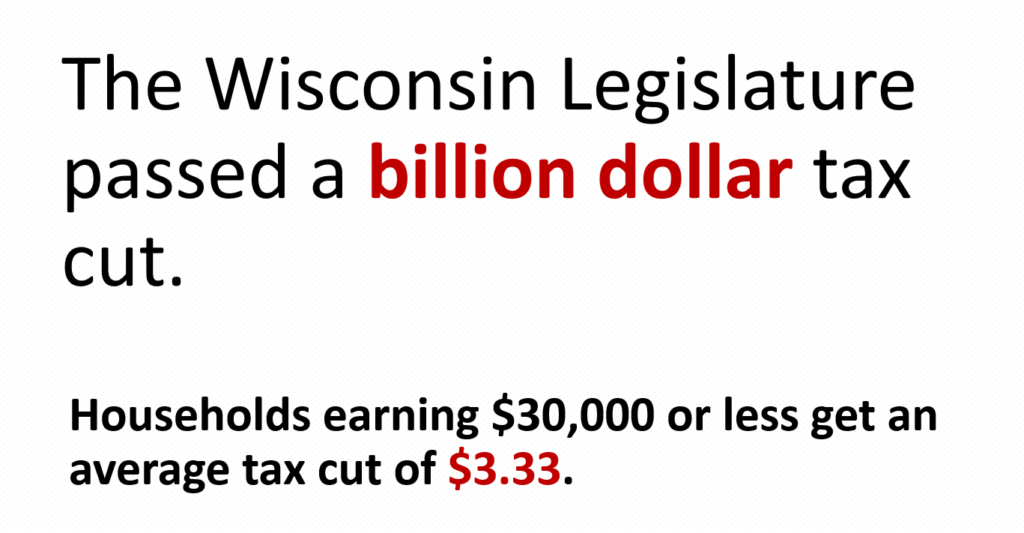

In the budget, lawmakers reduced income tax rates for some taxpayers, although they left out taxpayers with the lowest incomes. The cost of the income tax cut adds up to more than $2 billion over the two-year budget period, representing a very large loss of revenue that the state could have better put to use strengthening Wisconsin businesses, protecting Wisconsin families, and building up Wisconsin communities.

In contrast to the huge income tax cut, the legislature provided only $105 million in new resources from state tax dollars that K-12 schools can put to use educating Wisconsin children over the next two years. Put another way, lawmakers invested about 1/20th the amount of new resources in school classrooms as they allocated to this tax cut.

Another comparison: lawmakers put only $7 million in new state tax dollars into the entire University of Wisconsin System over the next two years, an amount that is roughly 1/300th the size of the tax cut. And to make an even more dramatic comparison, the amount of new tax money that lawmakers put into making Wisconsin a better place for both workers and employers through the Department of Workforce Development was just 1/2500th the size of the tax cut.

In fact, the amount of dollars lost to the income tax cut is more than ten times the increase in new state tax dollars that were allocated to K-12 classrooms, health, children and families, the UW System, and workforce development…combined!

The fact that lawmakers chose to not invest in Wisconsin residents is just one of the problems with this huge tax cut. The other is that the tax cut almost completely leaves out households with low incomes, instead funneling money into the pockets of the households that need it less. Over the course of a year, families with incomes under $30,000 will receive an average of just $3.33 from this tax cut. Most low-income families will get nothing at all.

For Wisconsin’s economy to work for everyone, our state needs to invest in healthy and well-educated workers and communities, public infrastructure, and working families. Our state must also invest in its communities of color and help eradicate systemic barriers to shared prosperity. By passing a very large tax cut and refusing to invest in crucial priorities our communities need, state lawmakers are turning away from the chance to ensure that every person in the state has full access to opportunity.