July 24, 2019

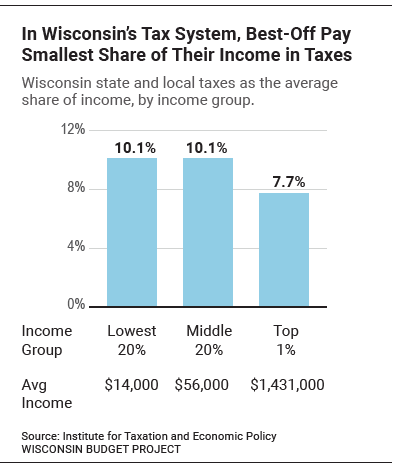

State tax policies can be a powerful tool for expanding opportunity and enhancing racial and ethnic equity. But right now, Wisconsin’s tax system calls on the richest residents to pay the smallest share of their income in taxes and requires residents with low and moderate incomes to pay more than their fair share.

Governor Evers proposed tax changes in his 2019-21 budget plan that would reshape Wisconsin’s tax code to give less of an advantage to the wealthy, by reining in tax breaks for the rich and redirecting the benefits to the middle class and people with low incomes.

The Legislature took a different approach, passing a budget that cuts taxes for the middle class but leaves untouched the preferential tax treatment that Wisconsin’s richest residents receive, and that slightly increases the amount paid by residents with the lowest incomes. After issuing some partial vetoes that did not substantially affect taxes or fees, the governor signed the budget into law.

Effects of Current Tax Preferences

Wisconsin’s tax system gives an advantage to very rich taxpayers by requiring them to pay a smaller share of their income on average than any other income group, while requiring taxpayers with lower incomes to pay correspondingly more of their income in taxes. Wisconsin taxpayers in the top 1% by income – a group with an average income of $1.4 million – pay just 7.7% of their income in state and local income taxes. In contrast, taxpayers in the bottom 20% by income, who have an average income of $14,700, pay 10.1% of their income in taxes on average.

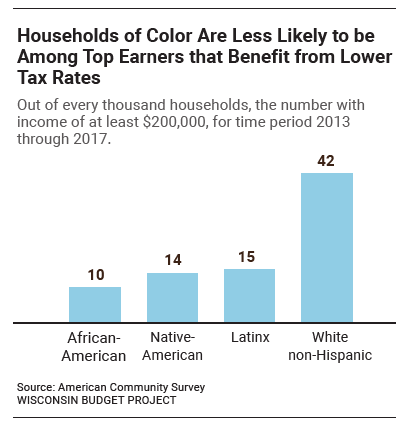

By providing tax advantages to people with high incomes, Wisconsin’s tax system keeps taxes low for wealthy, typically white residents, requiring many people of color and other taxpayers to make up the difference.

A long history of employment discrimination, unequal educational opportunities, and lack of public investment in communities of color have led to large income disparities among Wisconsin residents of different races. In Wisconsin, 43 out of every 1,000 white non-Hispanic households have more than $200,000 in income, compared to just 10 African-American households, 14 Native-American households and 15 Latinx households. That means that white households are three to four times as likely as African-American, Native-American, and Latinx households to have very high incomes, and are substantially more likely to be able to take advantage of tax breaks offered to the wealthy. Among Asian households, 76 out of every 1,000 households have incomes of $200,000 or more.

Governor’s Plan Would Have Helped Level the Playing Field for Taxpayers, But Legislature’s Does Not

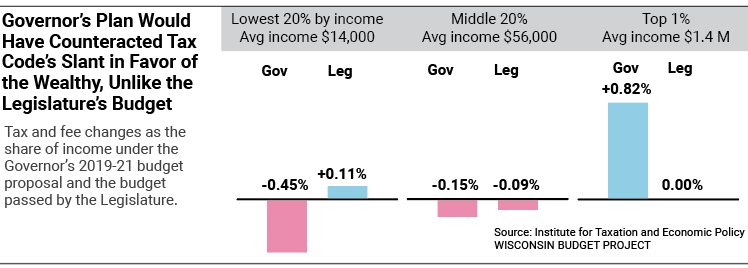

Taxpayers in different income groups would fare differently under the two plans. The governor’s plan would have adjusted the tax system to give less preference to the very wealthy, although they would still pay a smaller share of their income in state and local taxes than any other income group on average. In contrast, the Legislature’s approach increases the amount that taxpayers in the lowest income group pay, and leaves preferences for high-income taxpayers unchanged.

Here are how different income groups would have fared under the governor’s proposed budget compared to the Legislature’s budget. This analysis also includes Assembly Bill 251, which incorporates some tax changes that were originally proposed in the governor’s budget bill:

- Low-income taxpayers: Under the governor’s plan, the amount paid by taxpayers in the lowest group of 20% by income would have decreased by 0.45% of their income. Under the Legislature’s plan, the amount those taxpayers pay increases by 0.11% of income. This group has an average income of $14,000.

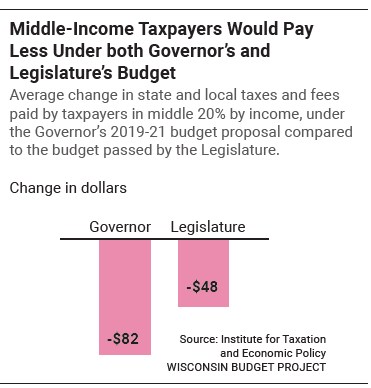

- Middle-income taxpayers: Both plans would reduce the amount paid by taxpayers in the middle 20%. Under the governor’s plan, the amount paid by taxpayers in the middle group would have decreased by 0.15% of income, compared to a 0.09% of income reduction under the final budget. This group has an average income of $56,000.

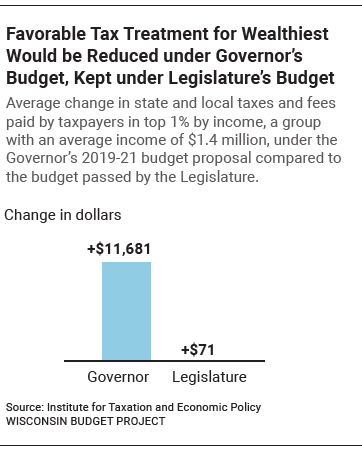

- High-income taxpayers: Under the governor’s plan, the amount paid by taxpayers in the highest 1% would have increased by 0.82% of income, the largest change of any group. The final budget, on the other hand, preserves the tax system’s preference for the wealthiest and includes only a minimal change in the amount they pay. This group has an average income of $1.4 million.

This analysis includes figures describing how the governor’s plan and the final budget would affect taxpayers at different income levels. The distribution of the tax and fee changes was modeled by the Institute for Taxation and Economic Policy, a non-profit organization that researches federal, state, and local tax issues and provides information on the effects of tax policies. Changes in taxes paid are average amounts across income groups. The appendix includes information about the methods used to model the effects of tax changes, as well as specifics about the tax and fee changes included in this analysis.

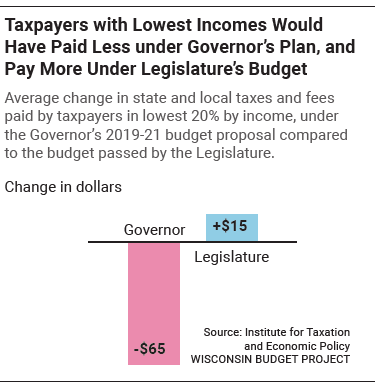

Taxpayers with Lowest Incomes Would Have Paid Less Under Governor’s Plan, and Pay More Under Legislature’s Plan

The governor’s plan would have helped even out a tax system under which residents with the lowest incomes pay a higher share of their income in state and local taxes than taxpayers with the very highest incomes. Taxpayers with incomes in the lowest 20% by income – a group with an average income of $14,000 – would have received a tax cut under the governor’s plan, but will pay more in taxes and fees under the budget passed by the Legislature.

Taxpayers with the lowest incomes would have paid an average of $65 less in taxes and fees annually under the governor’s budget, representing a decrease of 0.45% as a share of income. Under the budget passed by the Legislature, taxpayers in this group will pay more, with an increase of $15 in taxes and fees on average, representing an increase of 0.11% increase as a share of income.

Both the governor and Legislature included transportation-related tax and fee increases that would fall most heavily on people with low incomes. But the governor’s plan more than offset that increase by designing his middle class tax cut in a way that provided at least a small tax cut to people with the lowest incomes. His plan also expanded two tax credits targeted at people with low incomes: The Earned Income Tax Credit, which increases tax refunds for working parents, and the Homestead Credit, which reduces property taxes for owners and renters with low incomes. In contrast, the budget passed by the Legislature does not include any changes aimed specifically at reducing taxes for people with low incomes.

| Taxpayers with Lowest Incomes Will Pay More Under the Budget Passed by LegislatureAverage change for taxpayers in lowest 20% by income, a group with an average income of $14,000. The effect of each policy change is shown in isolation, not accounting for the impact of other changes. Interactive effects among different components mean that the effect of the individual components cannot be summed to the total. | ||||

| Proposed Tax or Fee Change | Dollars | Change as share of income | ||

| Governor | Legislature | Governor | Legislature | |

| Earned Income Tax Cut expansion | -$31 | NA | -0.21% | NA |

| Middle class tax cut | -$27 | -$4 | -0.18% | -0.03% |

| Homestead Credit expansion | -$14 | NA | -0.10% | NA |

| Reduction in bottom income tax rate | -$4 | * | -0.03% | * |

| Collecting sales tax from online sales | +$5 | +$5 | +0.04% | +0.04% |

| Transportation taxes and fees | +$27 | +$17 | +0.19% | +0.12% |

| Increase in Lottery property tax credit | NA | -$3 | NA | -0.02% |

| Total tax changes | -$65 | +$15 | -0.45% | +0.11% |

| * The Legislature’s budget also reduced the bottom tax rate, the effects of which are included in the middle class tax cut row for the Legislature. The effect in the governor’s budget is broken out separately due to interactive effects among tax change components. |

Taxpayers with Middle Incomes Would Receive a Tax Cut Under Both Plans

Taxpayers with incomes in the middle 20% by income would get tax cuts under both the governor’s budget and the Legislature’s budget, on average. This group has an average income of $56,000.

The governor’s plan would have given middle-income taxpayers an average income tax cut of $82, or 0.15% when measured as a share of income. The budget passed by the Legislature gives middle-income taxpayers a smaller tax cut: $48, or 0.09% of income.

| Taxpayers with Middle Incomes Would Receive Tax Cuts Under Both Plans Average change for taxpayers in middle 20% by income, a group with an average income of $56,000. The effect of each policy change is shown in isolation, not accounting for the impact of other changes. Interactive effects among different components mean that the effect of the individual components cannot be summed to the total. | ||||

| Proposed Tax or Fee Change | Dollars | Change as share of income | ||

| Governor | Legislature | Governor | Legislature | |

| Middle class tax cut and rate cuts | -$135 | -$95 | -0.24% | -0.17% |

| Reduction in bottom income tax rate | -$20 | * | -0.04% | * |

| Earned Income Tax Credit expansion | -$7 | NA | -0.01% | NA |

| Homestead Credit expansion | -$3 | NA | minimal | NA |

| Limit manufacturing credit | +$2 | NA | minimal | NA |

| Collecting sales tax from online sales | +$15 | +$15 | +0.03% | +0.03% |

| Transportation taxes and fees | +$69 | +$39 | +0.12% | +0.07% |

| Increase in Lottery property tax credit | NA | -$7 | NA | -0.01% |

| Total tax changes | -$82 | -$48 | -0.15% | -0.09% |

| * The Legislature’s budget also reduced the bottom tax rate, the effects of which are included in the middle class tax cut row for the Legislature. The effect in the governor’s budget is broken out separately due to interactive effects among tax change components. |

For Taxpayers with High Incomes, Favorable Treatment Would Have Been Reduced under Governor’s Budget, but Continues under Legislature’s Budget

Governor Evers’ budget included changes that would have reshaped Wisconsin’s tax code to give less of an advantage to wealthy taxpayers, by reining in tax breaks for the rich and redirecting the benefits to the middle class and people with low incomes. In contrast, the Legislature’s budget will have almost no effect on the wealthiest taxpayers.

The governor’s plan would have raised taxes and fees by an average of $11,681 on average for taxpayers in the top 1% of income, a group with an average income of $1.4 million. That increase represents 0.82% of their income on average. The budget passed by the Legislature increases taxes and fees paid by the top 1% by $71, an amount that rounds to zero as a share of their income.

| Favorable Tax Treatment for Wealthiest Individuals Would Have Been Curbed under Governor’s Budget, and Are Maintained under Legislature’s Budget Average change for taxpayers in top 1% by income, a group with an average income of $1.4 million. The effect of each policy change is shown in isolation, not accounting for the impact of other changes. Interactive effects among different components mean that the effect of the individual components cannot be summed to the total. | ||||

| Proposed Tax or Fee Change | Dollars | Change as share of income | ||

| Governor | Legislature | Governor | Legislature | |

| Middle class tax cut | $0 | -$172 | 0.00% | -0.01% |

| Reduction in bottom income tax rate | -$33 | * | Minimal | * |

| Collecting sales tax from online sales | +$91 | +$91 | +0.01% | +0.01% |

| Transportation taxes and fees | +$261 | +$227 | +0.02% | +0.02% |

| Limit on capital gains loophole | +$5,266 | NA | +0.37% | NA |

| Limit manufacturing credit | +$6,680 | NA | +0.47% | NA |

| Increase in Lottery property tax credit | NA | -$76 | NA | -$0.01% |

| Total tax changes | +$11,681 | +$71 | +0.82% | Minimal |

| * The Legislature’s budget also reduced the bottom tax rate, the effects of which are included in the middle class tax cut row for the Legislature. The effect in the governor’s budget is broken out separately due to interactive effects among tax change components. |

Conclusion

In Wisconsin and elsewhere, the wealthiest have seen their incomes skyrocket in recent decades, while incomes have stagnated for the middle class and those who struggle to make ends meet. Wisconsin’s state and local tax system contributes to the growing chasm between the very rich and everyone else, by calling on the richest residents to pay the smallest share of their income in taxes, and requiring everyone else to make up the difference. The tax changes proposed by Governor Evers would have been a first step in moving our tax system closer to being a level playing field for Wisconsin families and businesses.

By sticking to the status quo, lawmakers have squandered an opportunity to create a more equitable tax code. Instead, they have maintained a system that requires people of color and people with low or moderate incomes to make up for the tax breaks provided to the state’s wealthiest residents. Propping up a tax code that favors the wealthy, at the expense of everyone else, makes it harder for Wisconsin families and communities to prosper.

Appendix

In addition to tax and fee changes in the 2019-21 budget, this analysis also includes tax changes included in 2019 Assembly Bill 251, which incorporates changes similar to ones included in the governor’s budget proposal.

ITEP’s web page has more information about their microsimulation tax model.

| Tax and Fee Changes Included in this Analysis | |||||

| Dollar amounts shown in millions, for combined 2020 and 2021 fiscal years. Tax cuts are shown as negative numbers. | Governor | Legislature | |||

| Tax change | Distributional effect | Proposed change | Two-year amount | Change | Two-year amount |

| Middle class tax cut | Cuts taxes for middle class | Nonrefundable credit of 10% of tax liability | -$833.6 | Reduce tax rate on 2nd lowest income bracket | -$321.5 |

| Change rates based on online sales tax revenues | Largest tax cuts as share of income are for low to middle-income taxpayers | Reduce tax rate on lowest income bracket | -$63.2 | Reduce tax rates on two lowest income brackets | -$136.0 |

| Earned Income Tax Credit | Lowers taxes for working parents with low incomes | Increase refund for some parents | -$53.1 | No change | NA |

| Homestead property tax credit | Lowers taxes for homeowners and renters with low incomes | Increase some formula factors and link them to inflation | -$38.9 | No change | NA |

| Vehicle title fees | Like gas tax, falls more heavily on low-income households. | Increase by $10 | +$35.7 | Increase by $95 | +$272.9 |

| Sales tax collection | Largest tax increases as share of income are for middle-income taxpayers | Expand sales tax on online sellers | +$93.9 | Same, but in Assembly Bill 251 instead of budget | +$93.9 |

| Capital gains exclusion | Mainly benefits high earners | Limit | +$505.1 | No change | NA |

| Manufacturing Credit | Almost exclusively benefits extremely high earners | Limit | +$516.6 | No change | NA |

| Gas tax | Low-income households pay a higher share of their income in gas tax than higher-income households | Increase 8 cents and link to inflation going forward | +$526.5 | No change | NA/ |

| Annual vehicle registration | Like gas tax, falls more heavily on low-income households | No change | NA | Increase by $10 | +$65.3 |

| Lottery property tax credit | Only benefits homeowners, who tend to have higher incomes than renters | No change | NA | Increase | -$58.6 |

| Source: Dollar amounts are from Legislative Fiscal Bureau documents |