September 9, 2021

For Wisconsin’s economy to thrive, the state needs to invest in the building blocks of shared prosperity, including high-quality early education and schools, affordable higher education, healthy workers, and strong communities. The Governor’s budget proposed making significant investments in those areas, including investments that would improve racial equity, but the final budget approved by the Legislature looks far different.

Without raising tax rates, the Evers budget would have generated a net increase of about $1 billion in tax revenue and would have made a number of changes to create a tax code that is less slanted in favor of corporations and wealthy Wisconsinites.

As the Legislature’s Joint Finance Committee was crafting its version of the budget, new revenue estimates projected an unprecedented jump in state revenue. The new projections increased the tax estimates by a total of $4.4 billion over three years!

The Legislature could have used the additional revenue to fund the sorts of investments that Evers’ budget proposed in areas like K-12 and higher education, infrastructure and human services. Instead, the Legislature rejected nearly all of the investments the Governor recommended, eliminated all the changes he proposed to generate revenue and create a more level playing field, and instead adopted a very large income tax cut that makes the state tax code even more slanted in favor of the rich and powerful.

A huge tax cut that primarily benefits the very wealthy and provides little benefit to people of color

Soon after the Legislative Fiscal Bureau released the new revenue estimates, the Joint Finance Committee approved cutting income taxes by $2 billion over the next two years. Thanks in part to the fact that the bill cuts the tax rate for the second-highest income bracket and not for the lower two brackets, the benefits are heavily slanted toward the very wealthy. The tax cut leaves behind Wisconsin’s low-income households and many people of color.

The following figures – gleaned from an analysis by the Legislative Fiscal Bureau – show how the huge income tax cut widens the substantial economic divide in our state:

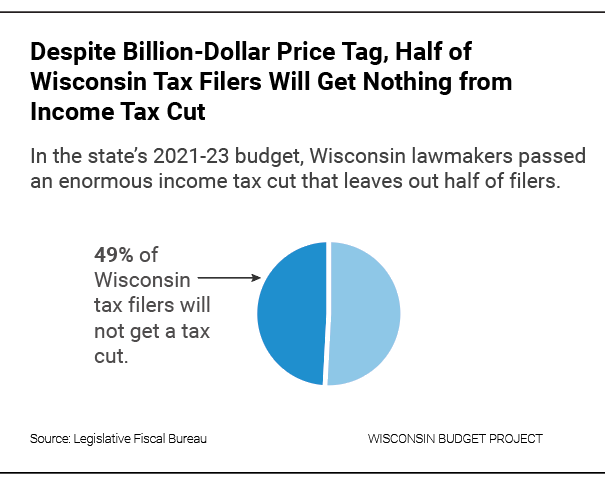

- Almost half of all tax filers (49%) receive no portion of the $1 billion per year tax cut.

- The top 20% of taxpayers (those making more than $90,000) receive 79% of the tax cut.

- The average tax cut among all tax filers earning less than $40,000 is less than $8 per year, whereas the average for tax filers making more than $300,000 per year is $2,785.

An analysis by the Institute on Taxation and Economic Policy (ITEP) found that the income tax cut will benefit white Wisconsinites far more than Black and Latinx state residents. The average income tax cut for white residents of our state is 2.4 times higher than the average for Blacks and almost twice the average for Latinx Wisconsinites.

That disparity isn’t simply because white Wisconsinites have higher incomes. Because the income tax rate cut does not apply to the lowest two brackets, it is targeted to disproportionately benefit higher income tax filers. The rate reduction applies to a larger proportion of their income than it does for lower income tax filers. As a result, the tax reduction for white Wisconsinites amounts to 0.39% of their income, compared to 0.29% for blacks and 0.31% for the state’s Latinx residents.

The continuation of past tax increases for low-income families

One way to make sure that poorer families benefit from tax cuts is to increase the refundable tax credits that low-income households receive; however, the Wisconsin Legislature has done the opposite. Back in 2011, Governor Walker and the Republican Legislature raised taxes on low-income families by reducing both the Earned Income Tax Credit and the Homestead Credit. And several years later, they further reduced the Homestead Credit, even as they were approving new tax cuts for more affluent state residents. In fact, since the beginning of 2011. Walker and the Legislature made tax changes cutting state revenue by a cumulative $13 billion, yet they never reversed the tax increases approved in 2011 for the state’s lowest income households.

Governor Evers’ budget attempted to make Wisconsin’s tax code more equitable by making changes in both of these refundable tax credits:

- Expanding the Earned Income Tax Credit – Evers proposed a change that would have increased the EITC for an average of about $350 for about 200,000 families with low-wage workers.

- Improving the Homestead Credit – The Governor proposed raising to $30,000 the annual income cap for people receiving this credit, and allowing the parameters used in the calculation of the credit amount to rise with inflation. Those two changes would cut taxes for low-income homeowners and renters by $69 million over the next two years.

While the Legislature was approving a mammoth tax cut for higher income state residents, it could have easily used a bit of that funding to enable low-income families to also benefit. However, Republicans in both houses rejected the Governor’s recommendations for providing targeted tax cuts to the state’s poorer families. They also removed his proposal for a new income tax credit for up to 50% of the cost of certain expenses incurred by family caregivers, which would have reduced their taxes by about $100 million per year.

New figures released on September 2, 2021, reveal that tax collections in fiscal year 2020-21 were actually $319 million more than the amount assumed when the budget bill was crafted. As a result, state lawmakers may propose additional tax cutting. If so, they should start by increasing the tax credits that help the low-income Wisconsinites whose taxes were raised in 2011, and who were left out of the tax cuts included in the 2021-23 budget bill.

Preserving costly tax breaks that benefit corporations and the wealthy

One of the ways in which the state tax code has contributed to a wide economic divide in Wisconsin is the growth of tax breaks that primarily benefit the very wealthy. The Governor recommended changes to scale back (but not eliminate) two of those tax breaks that are particularly slanted in favor of very high income state residents:

- Limiting the manufacturing credit – Evers proposed significantly reducing a tax break that allows many manufacturers to pay no state income taxes. The manufacturing credit has ballooned far beyond original cost estimates and is slanted to favor a small group of multi-millionaires. Governor Evers proposed allowing manufacturers to claim this credit only for the first $300,000 of their income, which would reduce the cost of this credit by $487 million over the next two years.

- Taxing income from wealth at the same rate as income from work – Wisconsin is one of only a few states that gives preferential tax treatment to income earned from investments (also known as capital gains), taxing that income at a lower rate than income earned from working. Governor Evers recommended eliminating this preference for individuals with incomes above $400,000, and couples above $533,000. That limitation would have generated an additional $350 million in public revenue during the 2021-23 budget period.

These two changes and some smaller ones the Governor recommended would have ensured that big manufacturers and wealthy individuals pay their fair share of the state tax revenue that is necessary to fund thriving communities, excellent schools, and modern transportation networks. However, the Legislature rejected all of those changes.

Conclusion

Governor Evers introduced a budget bill that would significantly reduce the egregious economic and racial disparities in Wisconsin. One way in which his budget sought to do that was by making tax policy changes that would have made the tax code less slanted in favor of corporations and wealthy state residents. Those changes included closing tax loopholes in order to generate revenue needed for investments in areas like education, health care, and strong communities, all of which are building blocks for equity and shared prosperity.

By rejecting almost all of those measures, the Legislature squandered a golden opportunity to reduce the racial divide in our state. In addition, the budget they crafted will widen that divide because it contains a large, regressive income tax cut that will generally leave behind people of color and other Wisconsinites furthest from opportunity.

As the session continues, state lawmakers will have an opportunity to rethink these priorities and embrace policy changes that would improve both economic growth and equity by enabling all Wisconsinites to thrive.