A tax credit that allows manufacturers and some other businesses to pay next to nothing in income taxes has ballooned far beyond original cost estimates and is slanted to favor a small group of wealthy claimants, according to newly‑released figures.

The Manufacturing and Agriculture Credit, which lawmakers passed in 2011, nearly wipes out income taxes for manufacturers and agricultural producers — at a very steep price. The tax break reduces state income tax revenues by nearly $300 million in fiscal year 2017 and higher amounts in subsequent years. Most of the credit goes towards reducing income taxes for millionaires, with some tax filers with incomes of over $1 million receiving tax cuts of more than $100,000. In contrast, the small number of less affluent Wisconsinites who qualify for the credit receive far smaller tax cuts.

Companies do not need to create new jobs to be eligible to claim the credit. Even businesses that lay off workers, send jobs overseas, and close factories may receive the credit.

At the same time that the Manufacturing and Agriculture Credit (MAC) is giving very significant tax breaks to the very wealthiest individuals, lawmakers are cutting back on investments in Wisconsin’s education system and communities. In fact, Wisconsin’s cuts in state support for public schools and higher education system are among the largest in the country. By approving the MAC, lawmakers are giving a higher priority to giving tax cuts for the best-off than making the investments in Wisconsin’s schools and universities that are essential for a thriving economy.

Cost Climbs for Credit

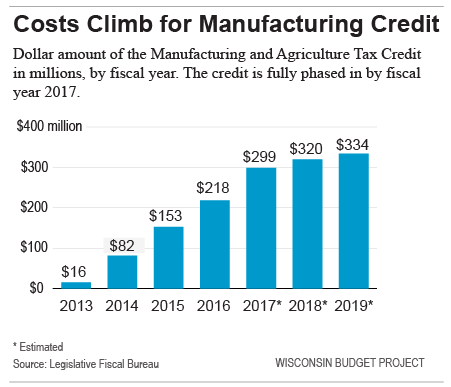

The Manufacturing and Agriculture Credit will cost the state an estimated $299 million in reduced revenue in fiscal year 2017, and more than $650 million in the upcoming two-year budget period that starts in July 2017.

When lawmakers approved the credit, they set it to phase in over several years. The cost of the credit started small — $16 million in 2013 — and grew in subsequent years, reaching an estimated $334 million by 2019. Fiscal year 2017 was the first fiscal year in which the credit was fully implemented.

The credit reduces the amount of income taxes, either corporate or individual, that would otherwise be owed on income from manufacturing and agricultural activities. In many cases, the credit will reduce the income taxes on that income to zero, wiping out any tax liability.

While both manufacturers and agricultural producers can receive the credit, about 90% of the tax cut goes to manufacturers.

Cost Overrun Takes Lawmakers by Surprise

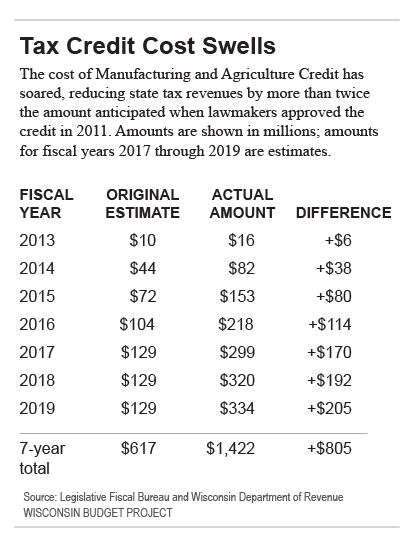

The cost of this credit has swelled far beyond the amount that lawmakers anticipated when they passed the tax break in 2011. Over a seven year period starting in fiscal year 2013, the cost overrun for the credit compared to the original estimate is expected to add up to $805 million.

Estimates prepared in 2011 projected that the tax break would cost $617 million between 2013 and 2019. While that amount is significant, it is far smaller than the $1.4 billion that the credit is now estimated to cost over that period, according to new figures from the Legislative Fiscal Bureau. Put another way, the new estimates show that the MAC cost has increased by 130% over the amount originally projected.

The cost overrun amounts have gotten larger over time, growing from $6 million in 2013 and growing to $205 million more than originally anticipated for 2019. In the budget period that runs from July 2017 to June 2019, the MAC is estimated to cost $397 million more than lawmakers anticipated when they passed the credit in 2011.

Part of the discrepancy between the original estimated cost and later estimations stems from the difficulty of predicting the degree to which credits based on business profits will reduce tax revenues. In a February 2015 letter, the Legislative Fiscal Bureau explained why the actual costs of the MAC differed so significantly from the estimates: “[B]usiness profits fluctuate considerably from year-to-year and are difficult to forecast accurately…Because of this uncertainty, the fiscal impacts of tax provisions that are based on business profits are inherently difficult to forecast reliably.”

Regardless of the reason, the MAC has turned out to be a tax cut that is more than twice as large as lawmakers originally intended. That means lawmakers could cut the amount of the credit in half and still give manufacturers an income tax cut that was more generous that what was originally intended.

A Boon for a Few

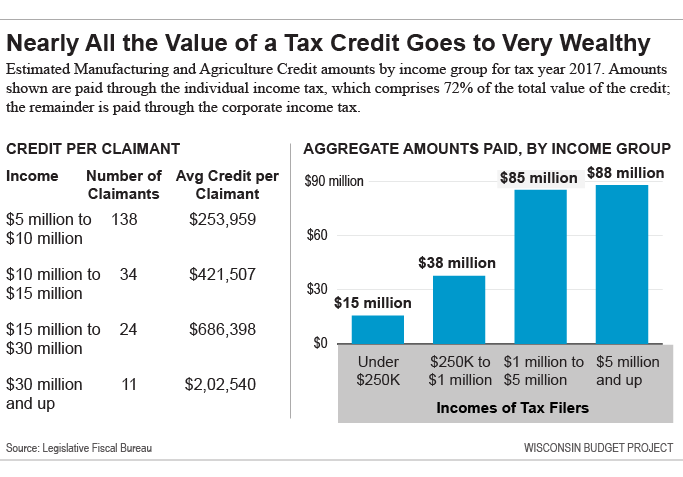

The MAC gives extremely large tax cuts to the very highest earners, with little of the credit going to tax filers with moderate or low incomes.

Tax filers with incomes of $5 million and higher receive an estimated 39% of the 2017 tax cut distributed through the individual income tax. The 207 claimants with incomes of $5 million and higher share a combined tax cut of $88 million from this credit. Their average tax cut for 2017 is $425,494.

Claimants with the very highest incomes receive an even larger tax cut. Tax filers with incomes of $30 million and higher receive an estimated 10% of the tax cut in 2017. There are 11 claimants with incomes of $30 million and higher, who share a combined tax cut of $22 million. Their average tax cut for 2017 is $2,020,540.

Just 7% of the tax cut goes to tax filers who earned less than $250,000.

Only about three out of every thousand individual income tax filers receive this credit. In 2017, an estimated 10,613 claimants receive the credit.

These figures are based on a Department of Revenue simulation, included in a January 20, 2017 letter from the Legislative Fiscal Bureau to Representative Gordon Hintz. The figures show the distribution for the portion of the MAC that is distributed through the individual income tax, which is about 72% of the total amount claimed. The remaining amount is claimed through the corporate income tax. Many businesses are structured as flow-through entities, passing profits through to owners who file individual income tax returns and would be eligible for the credit under the individual income tax.

A High Price Tag, with no Requirement to Create Jobs

Wisconsin taxpayers have little to show for the lost tax revenue caused by the MAC. A June 2016 review of the credit by the Wisconsin Budget Project could not find any evidence the credit had helped create jobs:

“Wisconsin added manufacturing jobs at exactly the same pace in the period before the credit as in the period after the credit. Both before and after the credit became available, the number of manufacturing jobs in Wisconsin grew more slowly than the number of jobs in other industries.

Both before and after the credit took effect, Wisconsin added manufacturing jobs at about the same rate as the national average.”1

Effective support for Wisconsin’s businesses could increase the number of good-paying jobs in Wisconsin and help the state remain a manufacturing leader. But the Manufacturing and Agriculture Credit is set up in a way that nearly eliminates the responsibility for some entities to pay income taxes, without requiring them to create a single new job.

At the same time that the MAC is giving very significant tax breaks to the very wealthiest individuals, lawmakers have cut back on investments in Wisconsin’s education system and communities. In fact, Wisconsin’s cuts in state support for public schools and its higher education system are among the highest in the country. By taking the revenue lost to the credit and reinvesting it in Wisconsin’s workforce and infrastructure, lawmakers could take a more effective approach to helping Wisconsin businesses thrive.

1 The Big Giveaway: Costly Tax Credit has Done Little to Boost Employment, Wisconsin Budget Project, June 28, 2016.