December 16, 2019

For our economy to work for everyone, Wisconsin needs to invest in strong communities across the entire state. But Wisconsin has gone back on its commitment to providing resources to local governments, forcing counties, cities, and towns to implement taxes and fees that fall most heavily on residents with the lowest incomes.

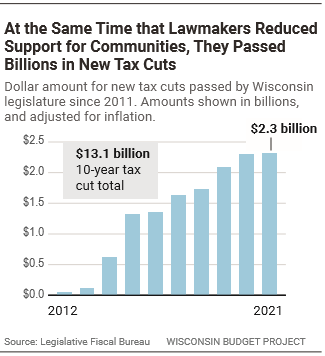

While state lawmakers have been reducing support to local communities, they have also been passing billions in tax cuts, providing a disproportionate benefit to the wealthy and well‑connected.

Local governments are the backbone of successful communities. Local governments plow roads, protect children from neglect and abuse, provide police and fire protection, immunize residents against deadly diseases, provide public transportation that people need to get to work, and perform other vital services that families and communities need to thrive.

Local governments need revenue to make these crucial investments in families and communities. Support from the state makes up one of the major sources of revenues for local governments. Yet state policymakers have starved local governments of state aid in recent years, while severely restricting property tax growth and limiting other options for local revenue. This combination of actions by the state legislature has forced harmful cuts to local services that keep families healthy and communities safe.

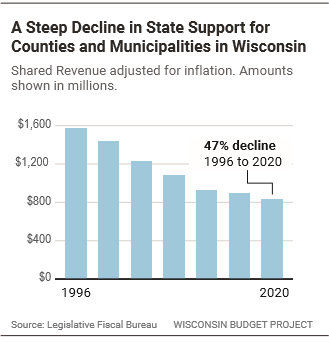

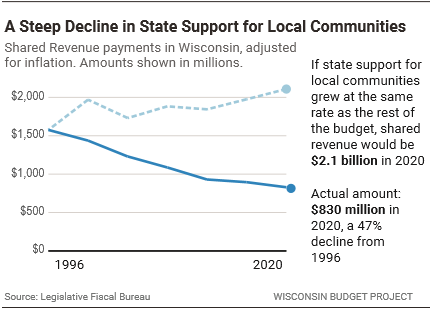

The largest and most flexible source of state support to local governments, referred to as “Shared Revenue,” is used by county and municipal governments to pay for a variety of critical services. The amount of Shared Revenue that the state provides to county and municipal governments has sharply declined in recent decades, with a decrease of 47% between 1996 and 2020, after adjusting for inflation. In dollar amounts, Shared Revenue fell from nearly $1.6 billion in 1996 to $830 million in 2020, a drop of $760 million. Meanwhile, local communities were responsible for providing services to a growing number of state residents, driving up costs.

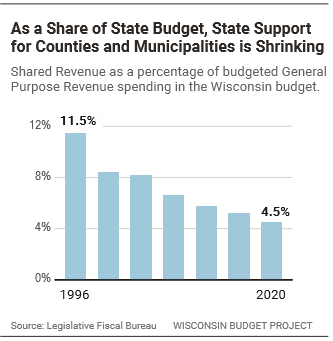

The decline in general support for counties and municipalities is especially notable given the increase in the overall size of the state budget during this period. These two trends – less support for counties and municipalities, and more spending in general – mean that the state is spending a much smaller share of each dollar on supporting local communities than it did in previous years. In 1996, the state spent 11.5¢ out of every dollar in the budget on Shared Revenue, an amount that dropped to 4.5¢ out of every dollar by 2020.

If the amount of state support for local communities grew at the same rate as the rest of the state budget, the state would be investing $2.1 billion in counties and municipalities in 2020 in the form of Shared Revenue, instead of the $830 million it is actually spending. That’s a difference of $1.3 billion in resources that aren’t available for Wisconsin communities to use to improve the lives of their residents.

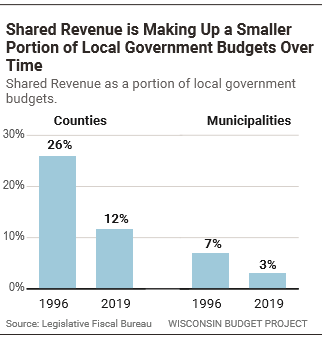

As the state has cut Shared Revenue, it makes up a shrinking portion of local government budgets. In 1996, Shared Revenue made up 26% of county budgets and 7% of municipal budgets. By 2019, those percentages had shrunk to 12% for county budgets and 3% of municipal budgets.

Shared Revenue isn’t the only form of state support for communities, though it is the largest and most flexible. Some of the other smaller forms of support, like resources to support mental health, substance abuse, developmental disability, and child welfare services administered by counties, have also dropped precipitously in recent decades. Other sources of support, like money that the state provides to local governments to build and maintain local roads, have remained relatively constant.

At the same time that lawmakers were reducing state support for communities, they were also passing billions in new tax cuts, many of which created or expanded tax loopholes for the rich and powerful. In 2021 alone, the new tax cuts will add up to $2.3 billion, dwarfing the cuts to Shared Revenue. State lawmakers could make up for the cuts in Shared Revenue by redirecting some of the recent tax cuts to communities, if they wished.

The decline in Shared Revenue puts a severe squeeze on local government budgets. The state caps the amount of money that local governments can raise through the property tax, their main source of revenue. The state allows local governments only a few other sources of revenue, most of which fall most heavily on people with the lowest incomes. One of these alternate sources of revenue is a local vehicle registration fee, also called a wheel tax, which requires owners of vehicles to pay a set amount for each vehicle they own. The number of communities levying a vehicle registration fee has increased sharply in recent years, from two in 2014 to 36 in 2019. Additional vehicle registration fees are slated to go into effect in 2020, including a $40 fee in the City of Madison, the highest in the state.

Some state representatives from Milwaukee County are seeking a different route to make up for the loss of revenue from the state: changing state law to allow Milwaukee County to add a 1% sales tax, if approved by voters at a referendum. A portion of the proceeds would be used for property tax relief, and the remainder distributed to local governments for services that improve the lives of their residents. This proposal has endorsements from organizations representing a varied group of constituencies, including Milwaukee’s business community and smaller municipalities in the county.

Both the sales tax and local vehicle registration fees fall more heavily on residents with low incomes than on residents with high incomes, because residents with low incomes have no choice but to spend more of their income on items subject to the tax or fee. Wisconsin’s state and local tax system is already stacked against people with low incomes and delivers major tax breaks to people with the highest incomes. When local governments take steps to raise a larger share of their revenue from people with low incomes, they further skew the tax system. Wisconsin’s unfair tax system imposes especially high costs on taxpayers of color, who are more likely than their white counterparts to work at low-wage jobs due to racial discrimination in the schools and workplace.

As the state has turned away from investing in local communities, it passed tax cuts enriching the wealthy and powerful. Local governments must structure their budgets within the framework permitted by the state, which gives them few options for both raising sufficient revenue to provide critical services to families and businesses and insuring that the revenue is raised from those who can afford it the most. Until the state recommits to providing support for local governments or allows new revenue sources, cities, towns, and counties have few options left and will be pushed to balance their budgets on the backs of those who can least afford it.

| Local Vehicle Registration Fees in Effect at End of 2019 | ||

|---|---|---|

| Location | Type of Government | Year Established |

| Milwaukee | City | 2008 |

| St. Croix | County | 2008 |

| Appleton | City | 2015 |

| Arena | Town | 2015 |

| Beloit | City | 2015 |

| Chippewa | County | 2015 |

| Gillett | City | 2015 |

| Iowa | County | 2015 |

| Kaukauna | City | 2015 |

| Fort Atkinson | City | 2016 |

| Janesville | City | 2016 |

| Lodi | City | 2016 |

| Marathon | County | 2016 |

| Prairie du Sac | Village | 2016 |

| Sheboygan | City | 2016 |

| Tigerton | Village | 2016 |

| Eden | Village | 2017 |

| Evansville | City | 2017 |

| Iron Ridge | Village | 2017 |

| Lincoln | County | 2017 |

| Milton | City | 2017 |

| Milwaukee | County | 2017 |

| New London | City | 2017 |

| Platteville | City | 2017 |

| Portage | City | 2017 |

| Dane | County | 2018 |

| Green | County | 2018 |

| Bellevue | Village | 2019 |

| Eau Claire | County | 2019 |

| Green Bay | City | 2019 |

| Manitowoc | City | 2019 |

| Montello | City | 2019 |

| Portage | County | 2019 |

| Rice Lake | City | 2019 |

| Richland | County | 2019 |

| Waterloo | City | 2019 |

| Source: Wisconsin Department of Transportation, Legislative Fiscal Bureau |